Central Banks & Commercial Banking

Fiat Currency

- Represented by Central Bank Notes & Commercial Bank Deposits

- Relies upon System of Ledgers

- Accepted for Taxes

- Legal Tender for All Debts Public & Private

Source: https://www.federalreserve.gov/paymentsystems/coin_data.htm

Central Banking Goals and Functions

- Economic Policy Goals, so-called ‘Dual Mandate’ by Federal Reserve

- “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates”

- Manage Fiat Currency

- Supply

- Physical Cash and Monetary Base

- Reserve and Capital Requirements

- Price

- Interest Rate Open Market Operations

- Foreign Exchange Interventions

- Exchange Controls

- Supply

- Oversee Fractional Banking System

- Provide Reserves

- Regulate and Supervise Banking System

- Promote Safe and Efficient Payment System

- Lender of Last Resort

- Banker to the Government

- Manage Foreign Exchange Reserves

- Conduct Government Bond Auctions

- Lender of Last Resort

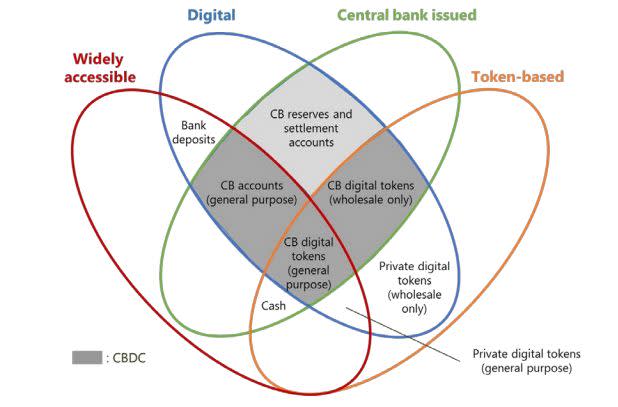

Central Bank Digital Currency (CBDC)

- Central Banks Currently Issue Digital Reserves to Commercial banks and Physical Tokens (Cash and Coin) to Public

- Commercial Banks Provide Digital Currency (Deposits) to Public, Essentially a form of Intermediated CBDC

- Private Sector is Experimenting with Stable Value Tokens

- Strategic question: Should Direct Access to Digital Reserves (from central bank to the public) be Expanded?

CBDC - Opportunities

- Continue Government Provision of a Means of Payment

- Promote Competition in Banking System

- Promote Financial Inclusion

- Address Payment System ‘Pain Points’

- For Some Nations, Avert Sanctions

CBDC - Challenges & Uncertainties

- Financial Stability and Potential to Increase Ease of Bank Runs

- Changes to Commercial Banks’ Deposits and Funding Models

- Effects on Credit Allocation and Economy

- Monetary Policy Implementation & Transmission

- Resilience of Open Payment Infrastructures

CBDC – Design Considerations

- Widely Accessible vs. Wholesale

- Token (e-Money) or Account (e-Deposit) based

- Issuer – Central Bank, Commercial Bank or Others

- Degree of Anonymity

- Transfer Mechanism

- Limits or Caps

- Interest Bearing and Level of Account Services

Private Sector Stable Value Tokens

- Fiat Collateralized: Tether, TrueUSD

- Crypto Collateralized: BitShare, Dai, Havven

- Commodity Collateralized: Digix, Ekon

- Not Collateralized ‘Seigniorage based’: Basis, Saga

The Money Flower

Source: https://www.ft.com/content/862f247b-005b-3915-b22a-542b5ab3736b