Financial System Challenges & Opportunities

Functions

- Investments (aka. Store of Value)

- Credit (aka. Borrowing Value)

- Risk Transformation

- Advice regarding Financial Assets and Liabilities

Sectors

- Commercial Banks & Credit Unions

- Investment Banks & Brokerage Firms

- Insurance Companies & Underwriters

- Collective Investment Vehicles, Mutual Funds, Pension Funds & Annuities

- Asset Managers & Financial Advisors

- Exchanges, Clearinghouses & Settlement Organizations

Financial Markets

- Primary Markets

- Secondary Markets

- Exchange Trading

- Over the Counter

- Asset Management

- Market Infrastructure

Ledgers

- Records Economic Activity and Financial Relationships

- Records Transactions and Accounts

Payment & Settlement Systems

- Method to Amend and Record Ledgers for Money & Financial Assets

- Authorizing, Clearing and Recording Final Transfers of Value

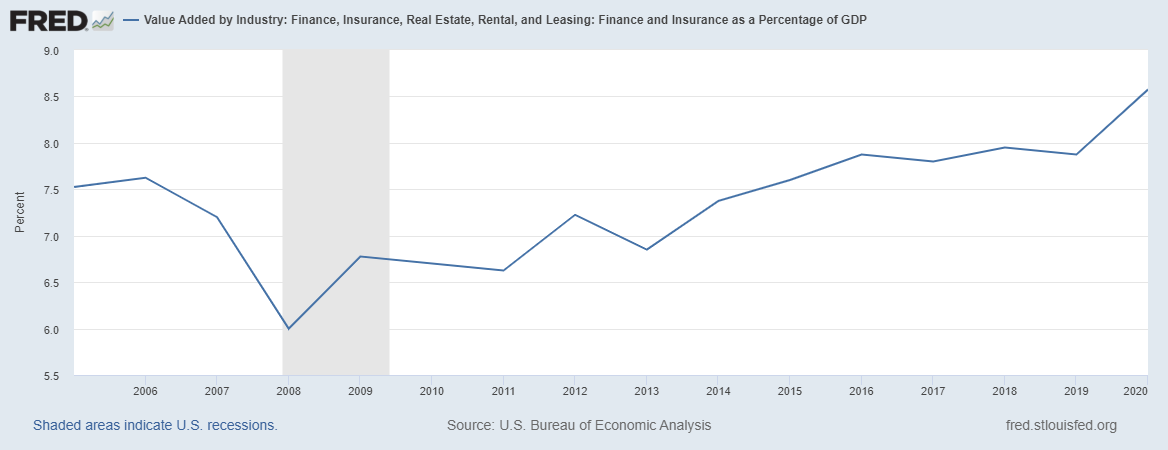

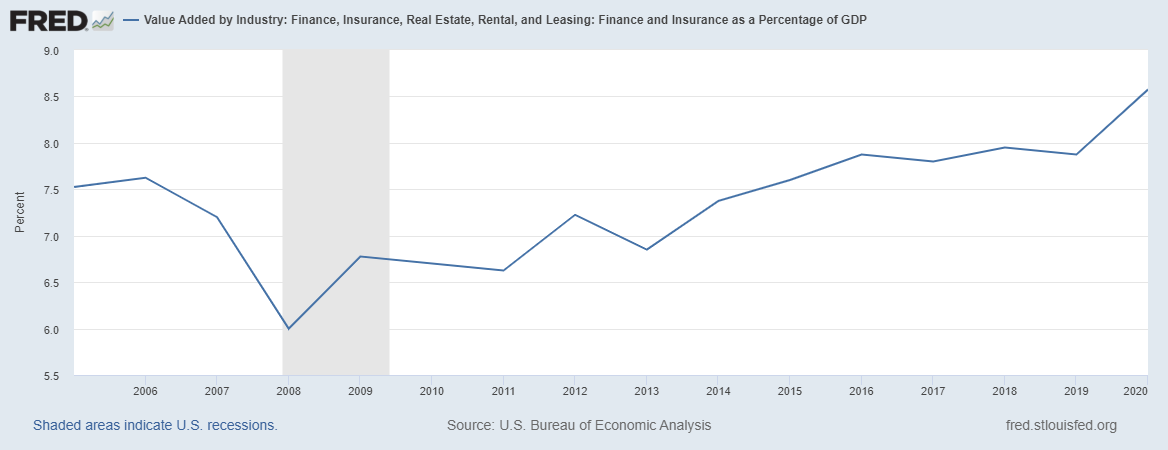

2008 Financial Crisis

- Weak Underwriting & Predatory Lending => Subprime Mortgage Crisis & Housing Bubble

- Easy Credit & Financial Derivatives => Increased Leverage & Interconnectedness

- Poor Risk Management & Incentive Structures => Many Vulnerable Financial Institutions

- Multiple Failures => Systemic Loss of Funding & Liquidity => Contagion & Near Collapse in Highly Interconnected System

Opportunities

- Legacy Customer Interface, Data, & Processing Systems

- Economic Rents

- Concentrated Risks

- Infrastructure Systems’ Costs & Counterparty Risks

- Periodic Crises and Instability

- Financial Inclusion

Potential Use Cases

- Payment Systems - Cross border, Large interbank, & Retail

- Central Bank Digital Currency & Private Sector Stable Value Tokens

- Secondary Market Trading – Crypto-exchanges & custody

- Venture Capital - Crowdfunding through Initial Coin Offerings

- Clearing, Settlement and Processing – Securities & Derivatives

- Trade Finance & Supply Chain - Digitizing paper-based processes

- Digital IDs and Data Reporting

____

22 February 2022

Share this post: