Behavioral Finance

- The Behavioral Biases of Individuals

- Behavioral Finance and Investment Processes

- Situational Profiling

- Investment Policy Statement IPS

- Monte Carlo Simulation

The Behavioral Biases of Individuals

Cognitive errors

Belief Perseverance: the tendency to cling to one’s previously held beliefs irrationally or illogically.Conservatism: people maintain their prior views or forecasts by inadequately incorporating new information.Confirmation: people tend to look for and notice what confirms their beliefs, and to ignore or undervalue what contradicts their beliefs.Reprensentativeness: people tend to classify new information based on past experiences and classifications.Base-rate neglect: people rely on stereotypes when making investment decisions without adequately incorporating the base probability of the stereotype occurring.Sample-size neglect: people incorrectly assume that small sample sizes are representative of populations

Illusion of Control: people tend to believe that they can control or influence outcomes when, in fact, they cannot.Hindsight: people may see past events as having been predictable and reasonable to expect.Prudence: the tendency to temper forecasts so that they do not appear extreme or the tendency to be overly cautious in forecasting.

Processing Errors: information may be processed and used illogically or irrationally in financial decision making.Anchoring and adjustment: the use of a psychological heuristic influences the way people estimate probabilities.Mental accounting: people treat one sum of money differently from another equal-sized sum based on which mental account the money is assigned to.Framing: a person answers a question differently based on the way in which it is asked (framed)Availability: people take a heuristic (sometimes called a rule of thumb or a mental shortcut) approach to estimating the probability of an outcome based on how easily the outcome comes to mind.retrievability: if an answer or idea comes to mind more quickly than another answer or idea, the first answer or idea will likely be chosen as correct even if it is not the realitycategorization: if an answer or idea comes to mind more quickly than another answer or idea, the first answer or idea will likely be chosen as correct even if it is not the realitynarrow range of experience: a person with a narrow range of experience uses too narrow a frame of reference when making an estimate.resonance: people are often biased by how closely a situation parallels their own personal situation.

Gamblers’ fallacy: a misunderstanding of probabilities in which people wrongly project reversal to a long-term meanHot hand fallacy: people wrongly project continuation of a recent trendConjunction fallacy: an inappropriate combining of probabilities of independent events to support a belief. In fact, the probability of two independent events occurring in conjunction is never greater than the probability of either event occurring alone;

Emotional biases

Loss-aversion bias: people tend to strongly prefer avoiding losses as opposed to achieving gains.Disposition effect: the holding (not selling) of investments that have experienced losses (losers) too long, and the selling (not holding) of investments that have experienced gains (winners) too quickly.Myopic Loss Aversion: investors presented with annual return data for stocks and bonds tend to adopt more conservative strategies (lower allocation to equities) than those presented with longer-term return data

Overconfidence bias: people demonstrate unwarranted faith in their own intuitive reasoning, judgments, and/or cognitive abilities.Certainty overconfidence: the perceived ability of the investors to actually pick the next big stock with absolute certainty.Prediction overconfidence: the confidence intervals that people assign to their investment predictions are too narrow.

Self-attribution bias: success is attributed to the individual’s skill, while failures are attributed to external factors.Self-Control Bias: people fail to act in pursuit of their long-term, overarching goals because of a lack of self-disciplineStatus Quo Bias: people choose to do nothing (i.e., maintain the “status quo”) instead of making a change.Endowment Bias: people value an asset more when they hold rights to it than when they do notRegret-Aversion Bias: people tend to avoid making decisions that will result in action out of fear that the decision will turn out poorly.Social proof: individuals are biased to follow the beliefs of a group.

Implications of Biases

- No thorough analysis regarding investment

- An undiversified portfolio.

- An inappropriate asset allocation

Overcome Biases

- Have a disciplined approach to investment decision making. An investment policy statement would help provide discipline

- Focusing on the cognitive error aspects of the behavior. Cognitive biases are easier to correct for than emotional biases, which are based on how people feel.

Behavioral Finance and Investment Processes

Investor Types

Barnewall Two-Way Model

- Passive Investors

- investors who have become wealthy passively—corporate executives, big firm lawyers or CPAs, heirs

- the smaller the economic resources an investor has, the more likely the person is to be a passive investor

- higher security need and a lower tolerance for risk

- Active Investors

- individuals who have been actively involved in wealth creation through investment

- have a higher tolerance for risk than they have need for security.

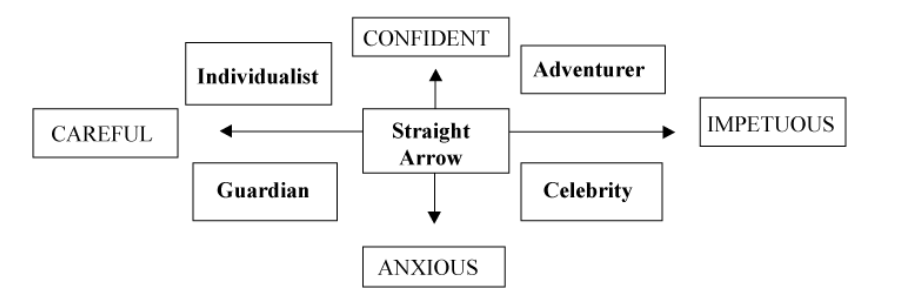

Bailard, Biehl, and Kaiser Model

Pompian 4 BITs

- Passive Preserver (PP)

- Basic type: Passive

- Risk tolerance level: Low

- Primary biases: Emotional

- Investment style: Conservative

- Friendly Followers (FF)

- Basic type: Passive

- Risk tolerance level: Low to medium

- Primary biases: Cognitive

- Investment style: Moderate

- Independent Individualist (II)

- Basic type: Active

- Risk tolerance level: Medium to high

- Primary biases: Cognitive

- Investment style: Growth

- Active Accumulator (AA)

- Basic type: Active

- Risk tolerance level: High

- Primary biases: Emotional

- Investment style: Aggressive

Behavioral Portfolio Theory

- Portfolios, affected by behavioral biases, are formed as layered pyramids in which each layer is aligned with an objective.

- Behavioral investors do not consider the correlation between the layers in the way that modern portfolio theory would suggest they should.

- Investors have multiple attitudes toward risk depending on which part of their wealth is being considered.

Situational Profiling

- Source of wealth

- Active wealth creation

- Passive wealth creation

- Measure of wealth

- Perception of wealth as small - lower risk tolerance

- Vice versa

- Stage of life

- Foundation: long-time horizon - higher risk tolerance, little financial wealth - lower risk tolerance

- Accumulation: maximum savings and wealth accumulation - higher risk tolerance

- Maintenance: retirement - risk tolerance declining

- Distribution: time horizon may extend beyond one’s death so time horizon is long - higher risk tolerance

Investment Policy Statement IPS

- Objectives: Return and Risk

- Constraints: TTLLU (Time Horizon, Taxes, Liquidity, Legal, Unique)

Return Objective

- Required return

- Desired return

- Pre- and After-tax return, adjusted for inflation

Example

Consider a client in a 30% tax bracket with $1,000,000, needing a $30,000 after-tax distribution at the end of the year with that amount growing at an estimated 2% inflation rate in perpetuity.

- First calculate the real, after-tax return: 30 / 1,000 = 3.00%.

- Then add inflation for the nominal, after-tax return: 3.00% + 2.00% = 5.00%.

- Last gross up for taxes to calculate the nominal, pretax return: 5.00% / (1 − 0.30) = 7.14%.

Risk Objective

- Ability to take risk

- Shorter time horizon (decreases ability to take risk)

- Large critical goals in relation to the size of the portfolio.

- High liquidity needs.

- Goals that cannot be deferred.

- Situations where the portfolio is the sole source of support or an inability to replace losses in value.

- Willingness to take risk

- Overall conclusion

Taxes

- Personal Income Tax

- Capital Gain Tax

- Wealth Transfer Tax

- Personal Property Tax

Legal

- Revocable trusts

- Irrevocable trusts

- Family foundation

- If there are no noticeable legal concerns, state there are none beyond your normal ethical responsibilities under the Code and Standards.

Unique

- Home ownership

- ESG

Monte Carlo Simulation

In Monte Carlo simulation, each of the variables is given a probability distribution to allow for real world uncertainty.

Pros

- Able to incorporate chanegs of variables overtime

- Able to incorporate statistical properties outside normal distribution such as skewness and kurtosis

- Able to incorporate alternative assets

- It considers path dependency, such as the interaction of changing inflation on the portfolio values and on the investor’s withdrawal needs.

- It can more clearly display tradeoffs of risk and return by ranking the paths from the best to worst

- Properly modeled tax analysis

- A clearer understanding of short-term and long-term risk can be gained.

- It is superior in assessing multi-period effects. Monte Carlo simulation can better model the real stochastic process where return over time depends not only on the starting value of the period but also on the additions or withdrawals to the portfolio at each future period.

Cons

- Poor or simplistic inputs or modeling can create poor results. Models that simulate the return of asset classes but not the actual assets held.